Previous Post: The Idea of SWIFT MT798 || My Own SWIFT MT700 Parser And Some More Stories :Next Post

The Following Blog Post Was Made On: 2017-02-23

The Basics Of SWIFT MT798

In my last post, I promised to discuss about the structure of MT798. I am assuming that you are already conversant with the Bank to Bank Swift Standard.

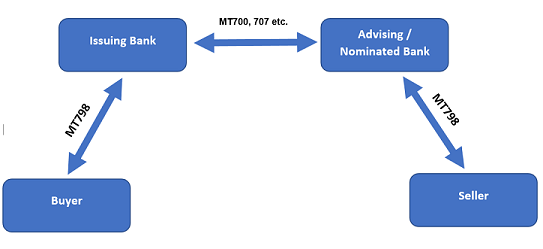

First let's discuss the Scope of this message. MT798 is a message specifically meant for communication between Bank and the corporate. Therefore, one bank cannot send a MT798 message to another bank. If we consider a LC / Guarantee transaction, here is how the flow would look like:

As you can understand from this image

>>A buyer would first send a LC application to Bank via MT798.

>>The bank will then issue the LC and sent it to advising bank via MT707.

>>The advising bank would advice the LC to seller via MT798.

We can keep this chain extending till the advice of payment by the presenting bank to the corporate. Now, we already know, there is specific SWIFT message for specific purpose. For example, for LC issuance, bank uses MT700, for amendments bank uses 707 and so on. Similarly, MT798 messages also have different formats for specific purposes.

But here is a twist. In Bank to Bank communication, for any particular purpose, there is only one message in one format. For example, if the purpose is LC issuance, the message format is MT700 and it looks like this:

{1:F01DRAFTBNKAXXX0132586693}{2:O7002017030214DRAFTBNKAXXX48465367570302141317N}{3:{108:00000000198202}}{4:

:27:1/1

:40A:IRREVOCABLE

:20:15315466

.................................................

.................................................

:72:SUBJECT TO UCP600

-}

:27:1/1

:40A:IRREVOCABLE

:20:15315466

.................................................

.................................................

:72:SUBJECT TO UCP600

-}

As you can see, this message has only one header block and one closing and the format is mentioned in the header. Whenever you see this “700†in the header, you know the message is a LC.

But in case of Bank - Corporate communication, in almost every case, there are TWO messages and TWO formats. For example, if the purpose is LC application, the message format is MT770 and MT700 and they look like this:

{1:F01DRAFTBNKAXXX0132586693}{2:I7982017030214DRAFTBNKAXXX48465367570302141317N}{3:{108:00000000198202}}{4:

:20:00000286460101

:12:770

.................................................

.................................................

-}

:20:00000286460101

:12:770

.................................................

.................................................

-}

{1:F01DRAFTBNKAXXX0132586693}{2:I7982017030214DRAFTBNKAXXX48465367570302141317N}{3:{108:00000000198202}}{4:

:20:00000286460102

:12:700

:77E:

:27A:2/2

:21A:I1608270053

:27:1/1

.................................................

.................................................

-}

:20:00000286460102

:12:700

:77E:

:27A:2/2

:21A:I1608270053

:27:1/1

.................................................

.................................................

-}

Together these two messages produce a complete result. Please notice the header block. For both messages, the format is MT798. Now MT798 only tells us that it's a communication between bank and corporate. So how we will understand the purpose of these messages? Here is the answer.

Every MT798 message includes a tag :12: which indicates the sub-message type. In the example messages, you will find 770 and 700 as the sub-message types. Thus, whenever we receive a MT798 message where the tag :12: reads 770, we instantly know that this a LC application and there is another part of this message (i.e :12:700) and we have to read them together to get the complete picture.

In my next post, I will try to explain the MT798 in greater details. Till then, you take care and stay fine.

Note: (Please do not confuse this MT700 with the Bank to Bank MT700. We will discuss this in detail later).